What is cash flow?

Cash flow is the total net amount of cash (or equivalent) moving in and out of a business aka property if it’s being looked at in the light of real estate. Think of it like a pump that goes in two directions. When it’s positive it pumps in and provides the owner with cash they can spend, reinvest or do whatever they please. When it’s negative it’s pumping out into someone else’s pocket and taking the owners cash with them.

Why do we care about cash flow in Real Estate?

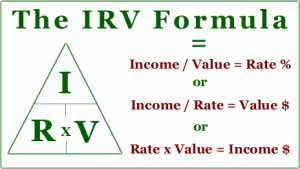

Cash flow is important for a few reasons, and many people even base their whole business model off high cash flow. It can tell whether a property is profitable. It allows investors to understand their returns like cash-on-cash, or annualized return. And most importantly cash flow is a critical component in an important formula called the IRV Formula, which is used to determine property values and cap rate.

Cash Flow & Net Operating Income (NOI)

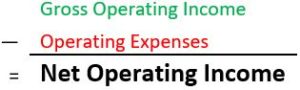

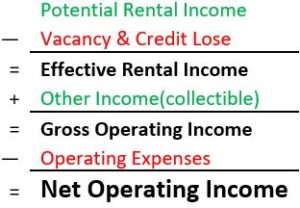

NOI is a type of measurement that identifies the ability of a property to generate cash flow or an income stream from its operation. In short it is the annual income generated from operating income collected, and deducting all the expenses incurred from operations (as shown by the formula below).

Components of Net Operating Income:

Potential Rental Income

Is the total rent a property can generate from its terms of each lease if it is 100% leased. If they’re no current leases, comparable properties can be used to determine the market rent.

Example: An apartment complex has 10 units. Every month the rental income when all units are occupied are as follows; 2 rent for $2000 each, 4 rent for $1500 each, and 4 rent for $1000 each. The Potential rental income would be the annual rental income of all 10 units = (2*2000+4*1500+4*1000) *12= $168,000.

Vacancy & Credit Lose

Is the amount of money or percentage of net operating income that is estimated to not be realized due to non-payment of rents and vacant units.

Example: All 10 units are fully rented however through the year two separate tenants living in the $1000 a month unit stop paying their rent. It takes two full months before they are evicted, and the units sit another month on the market before new tenants can be found as a replacement. The vacancy and credit lose would be 2 units * 3 months lost rent * $1000 rent = $6000 or 3.56%.

Other Income

that may come from real estate is income that is independent of from the rental income. This includes income such as laundry machines, billboard space, antennas, etc.

Example: 10 units share three washers and three dryers. The washers and dryers are coin operated. Each month on average the tenants spend around $600 at the machines. Also installed on the roof are a small batch of solar panels that generate $200 of power each month. Other Income would equal $9600 annually.

Operating Expenses

are cash expenditures made on a consistent basis to maintain and operate a property so it produces market rents. This includes real estate and personal property taxes, property insurance, management fees (on or off-site), repairs and maintenance, utilities, and other miscellaneous expenses such as accounting, legal, etc.

Example: A 10-unit apartment complex has a property manager that charges 10% of the potential rental income. Insurance for the previous year was $4500 and property taxes were assessed at $5200. Every month a landscape company trims bushes, plows snow and rakes leaves for $250 a month. Finally, for the past five years there has been on average $8000 spent on repairing toilets, replacing dishwashers and painting every time a new tenant moves in. The total operating expenses can be calculated at: $16,800+$4500+$5200+$3000+$8000=$37,500.

–Excluded operating expenses are most commonly debt services and capital expenditures but should be determined based on an investment and tax issue. Expenses that are excluded are usually determined based on whether the expenditure occurs annually (categorized as an operating expense), or less frequently (categorized as a capital expenditure). Excluded items include tenant improvements, reserves for replacement, capital expenditures, real estate commissions income taxes, depreciation (cost recovery), and interest and principal on debt encumbering the property.

Examples: A 10-unit complex just came on the market for $2.5million. It seems like a great opportunity and your agent puts in an offer. The deal closes a few months later and the broker gets paid $75k for facilitating the transaction. To finance the purchase a mortgage note was needed that included a fee of 2 points or 37,500 to acquire the property. After 10 years the property starts to get dated and you decide to replace the countertops in each unit with granite countertops costing $60k. Even though these are crucial to making your business run, each of these expenses are excluded from operating expenses since they are a onetime expense.

Cash Flow isn’t everything:

Everyone’s heard the term “Cash is King” however cash flow isn’t everything. There are circumstances where taking a negative cash flow could be beneficial. These cases are usually determined by looking at other external factors such as acquisition cost and sale prices. If you lost money each year on a property but in five years you could sell it for a 150% increase wouldn’t you take that investment?